The last decade has been all about FinTech which has played a crucial role in many areas of financial transactions through smart use of technology. And Python definitely scores as the most popular language to use.

Here is why.

As taught in most fintech course financial services need the most-apt application to optimize costs, planning and the amalgamation of financial services. A HackerRank investigative report suggests that Python is the most popular language in use for FinTech firms in the US.

The report by e-Financial Careers ranks Python among the top 6 machine codes for the banking sector. Thus, doing a Fintech Course at a reputed institute like Imarticus can help you with certification and giving you the ideal launch into the technological world of fintech where well-paying jobs abound and demand for personnel is fast becoming a rage.

The fintech data science advantages of Python:

The fintech startups work with financial transactions that need records to be unchangeable, immutable and hard to tamper with. Decisions cost money and setbacks when they go wrong. The industry thus needs a ready-to-use programming language with ample libraries, components and high-performance maturity such as Python.

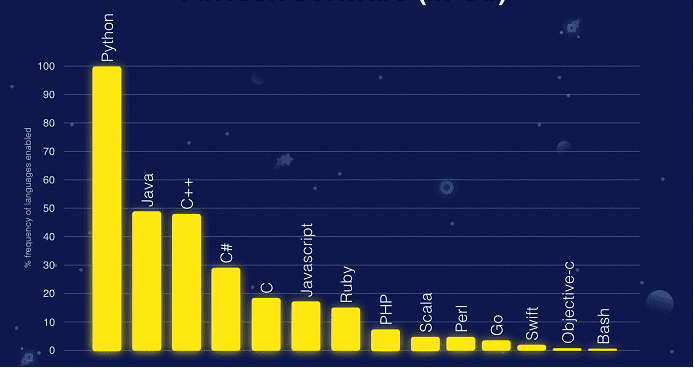

The Hacker Rank 2016 Study across the famous six of health care, media, and gaming, social media, security, fintech, and finance industries searched for the best popular programming knowledge.

Python, especially for fintech industries and as taught in Fintech courses, outstripped the rest by a huge margin in the performance testing on coding challenges. It also proved to be very popular in the financial sector.

The Python benefits:

Some outstanding features that set Python apart are

- Simplicity and accuracy: Python has low bug-rates and error rates than the other programming languages.

- Speed: Though not the fastest it scored in the time-to-market optimization tests.

- Syntax: The collaborative syntax is straightforward in Python and is easy for interconnecting the C-suite, developer and technical-expert languages.

- Libraries: The huge repository of free open-source libraries can be used for ready-made solutions in the financial and fintech sectors and are popular for training purposes in fintech courses.

Use of python in industries:

Python is being widely used today in banking and is widespread among the hedge, investment and corporate finance bankers. This is because of Python scores in handling quantitative challenges in trade management, risk management, and pricing. It also makes use of its large number of libraries to handle issues related to analytics, compliance, data, and regulation.

Bootstrapped fintech startups may use various back-end programming languages. But from the point of view of time, efficiency and effort spent, Python outdoes the rest for fintech use. It is growing very quickly and has the potential to be supportive in almost any industry it is used in. No wonder Python is so popular, reliable and accurate!

Python can hence be effectively used in software for the following sectors and is great at multitasking especially as a back-end server.

- Financial analysis

- Insurance

- Fintech

- Banking

- Stock markets

- Data analytics

- Cryptocurrency transactions.

Python Projects in Fintech:

Success and Python implementation are synonymous when blended with FinTech ideas. Look at the P2P lending platform Zopa which uses a mix of Java, C#, and Python. Zopa helps the borrowers and creditors transact free of intermediaries. And Python has helped the algorithmic models of Zopa execute complex transactions on blockchain enabled platforms.

Even the payments system like Stripe, Braintree, Paypal, and other receiving and processing systems use Python-based applications for the authentication of users and transactions mainly due to its wide array of ready-to-use libraries.

Conclusion:

Many fintech startups use C, R, Java, etc. But, Python is ideal for the challenges of the fintech industry. It has scored over many languages in its popularity over Java, C, R, SQL and others in the HackerRank challenges over the top 6 industries. Python emerged the ideal language for programming in the financial and fintech sectors. Obviously one would do well to learn Python because the top 6 industrial sectors are recruiting.

The jobs in the top industries prefer expertise in Python and are high-paying and have well-defined scope for progress and grow your career. If you want to learn the latest applications of Python in the fintech sector just check out the Fintech Training at Imarticus. Hurry as opportunities may be limited!

For more details, in brief, you can also contact us through the Live Chat Support and can even visit one of our training centers based in - Mumbai, Thane, Pune, Chennai, Hyderabad, Bangalore, Delhi, Gurgaon.