Financial institutions have to pay special attention to each customer and transaction to identify any fraudulent activity. A bank that has strong anti-money laundering policies will prevent people from depositing illicit money into any bank account.

Security policies are the main concern of financial institutions if they want to stop losses. Not only the financial institutions, but the government is also strict when it comes to money laundering.

Young enthusiasts that are looking to build a career in banking/finance should learn anti-money laundering skills to earn a better job offer. Read on to know more about anti-money laundering and different job roles in the industry.

Understanding money laundering via financial systems

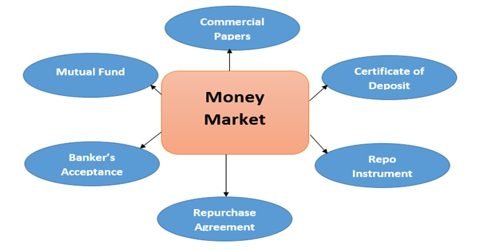

In the money market, many criminals try to coat the source of their incomes. You cannot deposit money obtained from any illegal activity in banks. Money laundering hides the source of the black money and makes it white. The dirty money is moved around in a financial system and, multiple transactions are made to confuse the bank officials. It also includes depositing black money in small amounts or transferring black money to a foreign country.

Once the dirty money is cleaned via money laundering, criminals can use it to finance criminal activities.

Once the dirty money is cleaned via money laundering, criminals can use it to finance criminal activities.

It will not only affect the financial institutions but also affects the country and the citizens.

Financial institutions have strong AML (Anti-money Laundering) policies in place that stop criminals from depositing money.

Performance areas of anti-money laundering jobs

The day-to-day job responsibilities of anti-money laundering professionals in banks are as follows:

- Anti-money laundering experts have to analyze the money market and uncover the pertaining risks within the financial institution. They are also involved in identifying and monitoring suspicious bank accounts or transactions.

- Anti-money laundering experts are aware of the current alerts generated by the law enforcement authorities. Many times, they help law enforcement to catch a money launderer.

- Procedural vulnerabilities and loopholes in the financial system are identified by anti-money laundering experts. All those areas that can be exploited by money launderers are identified by anti-money laundering professionals.

- Anti-money laundering professionals also offer expert advice to financial executives for maintaining high-risk accounts.

What are the job roles in Anti-money laundering?

The financial market is complex and, criminals are also using advanced money laundering techniques. There are different types of anti-money laundering jobs that work together to stop the movement of black money. The top types of anti-money laundering jobs are listed below:

- Junior Compliance Administrator: People who join the AML industry become junior compliance administrators. They have to carry out routine AML checking and administration of compliance processes in the bank.

- Risk & Compliance Officer: A risk & compliance officer will be involved in KYC (Know Your Customer) activities. The risk officer is also concerned with CDD (Customer Due Diligence).

- Fraud Investigator: Fraud investigators uncover the source of fraud in any financial institution.

- Chief Compliance Officer: It is responsible for forming better AML policies for the financial institution.

How to learn more about AML?

Many young bankers are choosing online risk management courses to know more about AML. The Certified Investment Banking Operations Professional course offered by Imarticus can be the right choice. This course will teach you about financial markets and risk management. You will also go through case studies to know more about real-world AML processes.

Conclusion

In this digital era, criminals are conducting complex money laundering attempts. To stop those attempts, banks need expert AML professionals in the coming years. With an online course in risk management, you can learn the required AML skills. Start your risk management course now!