Trade life cycle in Capital Markets

Any financial instrument traded in the market is determined by its supply and demand in the capital market. First, let us try to understand what are financial instruments and capital market. A financial instrument is a certificate of ownership for any kind of monetary contract between parties. It can be company shares or bonds or any stock owned by a person after a monetary arrangement and paid to the respective parties.

And a capital market refers to the place where different institutions and entities trade these financial instruments. For instance, the stock market in India is one of the biggest capital markets in the world, and the Bombay Stock Exchange (BSE) is the oldest in Asia. For better understanding, one can opt for Capital Market Course and capital market tutorial provided by experts in the domain.

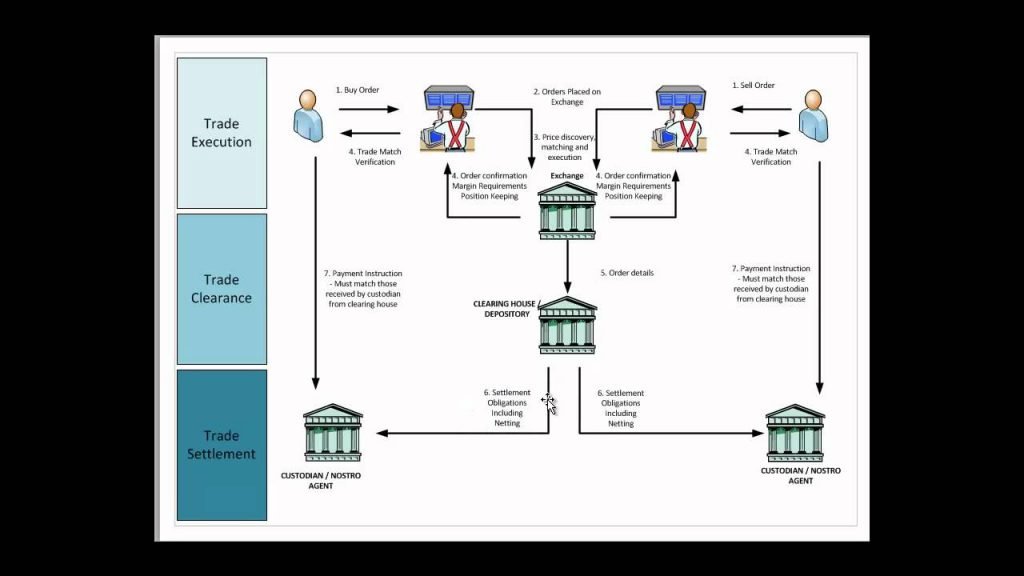

In order to understand how these financial instruments are traded, we first need to know the process of the trade life cycle. It follows the following steps:

1. Order Initiation and Delivery

The main idea behind any trade is the profit that one generates within a stipulated time though their investment. Similarly, in the stock market, an order is initiated by a retail client or an institutional investor through a broker or an agency, keeping in mind the perception of the movement of the share market. These orders are placed through the brokers with the help of online trading or through phone calls.

By market order, we mean the buy or sell or share or stocks of listed companies in the share market. When orders are placed, the broker or agencies record and process them carefully and allocate the shares or stocks to their respective clients.

2. Risk Management and Order Processing

In buying and selling shares by the investor, the broker places a query to verify whether sufficient balance is being maintained in the client’s account or whether sufficient stocks are available, respectively. Upon confirmation on the same, the order is placed while the order receipt is being generated. Any default by the investor has to be made good by the agency to the clearing institution. Therefore, the risk management by brokers or agencies comes at a price, called a margin which is levied by the clearing institute, and their responsibility to recover the same from their clients.

3. Order Matching and Trade Conversion

Once orders are collated by the broker from their clients with their respective quantity, amount, date and time, they are sent to the exchange for verification and to allot respective shares and volume accordingly. The clients are charged a minimum commission as a brokerage fee by the agencies and an official order confirmation through mail or post are being forwarded in the form of a contract note. The client details are recorded by the broker and are assigned a unique customer ID for each of them for trade convenience.

4. Trade Confirmation and Validation

An agency called a custodian is engaged by every institution in order to assist them in the clearance and settlement processes. The institution, with the assistance of their fund manager, sends details to the custodian about the order allocation including the type of securities, quantity, and price for the respective orders. This process prepares him to be aware of the trade details he is soon expected to receive from the broker along with their commission charges.

The custodian thus compares and validates the trade details and forwards an affirmation note to the broker. To know the basics of online trading and how it functions, nowadays it has become much easier as there are organizations offering capital market course and capital market tutorial by experts at reasonable rates.

5. Trade Settlement and Clearance

Trades executed are being collated and are settled 2 days after the transaction i.e. T 2 days. Once the clearing institute or corporation informs regarding their obligations to the investors on their securities and funds, the balance of payments are executed.

This follows the allocation of shares and funds in the respective demat accounts of the investors. Share amounts are credited to their linked accounts as sales proceed, and respective shares allocated for their volumes being invested. The detailed report is again forwarded by clearance houses to the guardian and to the exchange offices for records purpose.

Other Resources: