People are no more bound to visit a physical bank for any financial service. Fintech platforms have displaced the services of traditional banks. People can now make a transaction with ease via their smartphone while sitting on the couch. Due to the rise of fintech, professional learning courses have now changed their curriculum. Banking and finance courses are now including fintech concepts as it is in demand.

Most of the banks are now going digital and adopting fintech services. There is a huge demand in the market for fintech employees. In such a scenario, young aspirants must be taught about fintech concepts. Read on to know the next generation of fintech certification programs.

Understanding the fintech industry

Understanding the fintech industry

Why is there a need to change the curriculum of financial/banking courses? It is because bank officials are no longer involved in traditional activities only. New-age banks hire professionals that are skilled in technology besides traditional financial activities.

For example, consider a bank that has just launched its fintech platform. Besides cashiers and managers, the bank will also hire fintech experts to monitor the performance of the fintech platform.

Technology has changed a lot in the banking and finance sector. Age-old courses do not contain much information about the new-age technologies that are displacing traditional financial services. It is why young aspirants are demanding industry-oriented courses that could cover the recent innovations in the finance sector.

There are many fintech courses online but, not all follow an industry-oriented curriculum. By knowing about the recent innovation, it does not mean that one should ignore the core concepts of finance and banking. An effective online course will cover core concepts of banking/finance along with fintech innovations in recent times.

What should a new-age fintech course cover?

You should choose an online fintech course wisely. Choose a course that focuses less on outdated technologies and more on the latest innovations. The goal of an effective fintech course should be to teach students job-relevant skills. Some concepts that should be covered by a new-age fintech course in 2022 are as follows:

- Robotic Process Automation (RPA): RPA is widely used for automating several processes in the fintech industry. For example, RPA is used for client onboarding, loan processing, compliance management, claims processing, and many other tasks. With RPA, the burden of manual labour on fintech employees has been reduced. A new-age fintech course should cover RPA and its applications in the industry.

- Artificial Intelligence (AI): AI is widely used by fintech professionals for data analytics and forecasting. Smart AI algorithms can also detect frauds and money laundering activities with minimal human support. If you want to build a career in fintech, you should be fluent in new-age technologies like AI and RPA.

- Blockchain: The fintech industry also consists of cryptocurrency services and blockchain is the backbone of digital currency. Fintech professionals also use blockchain to store and manage transactional data securely.

- Cloud computing: Cloud computing is widely used by fintech professionals to store data. Fintech firms usually prefer cloud platforms for storing sensitive data as physical data centers are prone to cyberattacks.

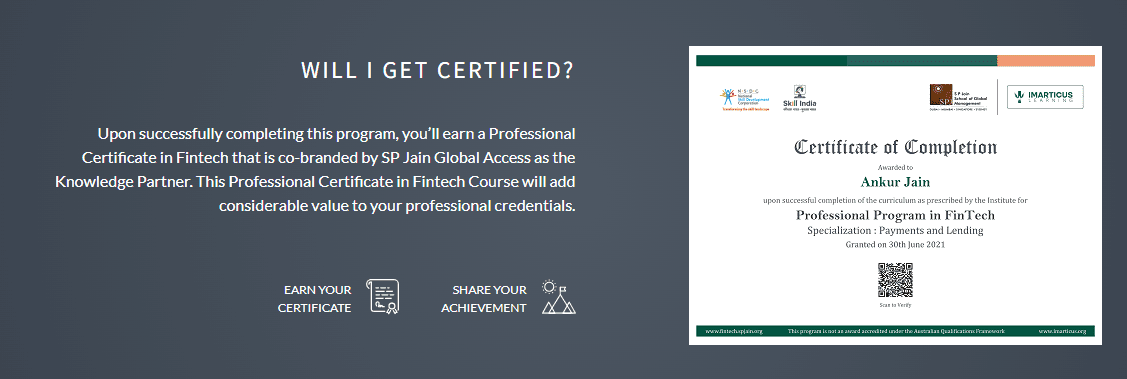

Besides the above technologies, there are many other new-age technologies used in the fintech sector. If you want to build a successful career in fintech, look for new-age courses that cover the latest innovations. We at Imarticus Learning offer an MBA program, a PGDM course, and a certification program in fintech for young aspirants.

Our Fintech online training covers all the latest technologies and tools used by fintech professionals. You will learn from industry experts and become ready to work in the fintech industry. Start your new-age fintech course right away!