Corporate organizations or individuals often borrow money to meet their business requirements. This is where credit risk needs to be considered as there might be a loss if the loan is not paid back. Credit risk assessment is essential and the process needs to be improved constantly.

A CRU Pro degree in credit risk and underwriting from Imarticus Learning can be of great help. The credit landscape is evolving and it is important to maintain the best practices.

How can you improve the credit risk process?

The credit risk process can be managed and improved with proper infrastructure and visualization. If you are interested in credit risk analysis, you should consider the credit risk underwriting course from Imarticus Learning.

The course will help you leverage current data and maintain the scorecard model. Here are some ways in which you can improve the credit risk process.

The course will help you leverage current data and maintain the scorecard model. Here are some ways in which you can improve the credit risk process.

- Constantly Check Data Sources

New data sources are available every day and you can use them to improve your portfolio. This is why you should evaluate all data sources available and apply them to your scorecard model.

- Scorecard Model Validation

Get your scorecard model validated by an independent auditor. A third-party auditor can check your scorecard model and help you understand how the model can be improved. This will not only help you maximize the effectiveness of your credit rules but also identify the model's weaknesses.

- Monitor Your Scorecard Model

Once your scorecard model has been validated, you should keep monitoring it. Scorecard models will degrade with time. But if you monitor it, you will know when you need to improve it. You can use specific resources to understand and track the rate of degradation. Then use specific software solutions to stabilize the model.

- Use Artificial Intelligence and Machine Learning

AI and machine learning can be used to improve credit risk. Such new technologies can be implemented on newer scorecard models to compare them with older ones. You will be able to understand how your scorecard model has evolved from a more traditional model. A credit analyst course will teach you how to use AI and machine learning for credit risk assessment.

- Use Current Software Solutions

There are several new software solutions available for credit risk management. You can use different tools to assess credit risk and manage the borrower lifecycle. You will also be able to keep your portfolio secure.

- Be Aware of Financial Crimes

To improve the credit risk process, you need to protect your portfolio. Financial fraud can happen at any time. But it increases due to an unstable or uncertain economy. So, you should always use the best cyber security technologies to detect and eliminate third-party attacks. When you take up a credit analyst certification course, you will learn how to protect your portfolio better.

Learn Credit Risk and Underwriting

Learn Credit Risk and Underwriting

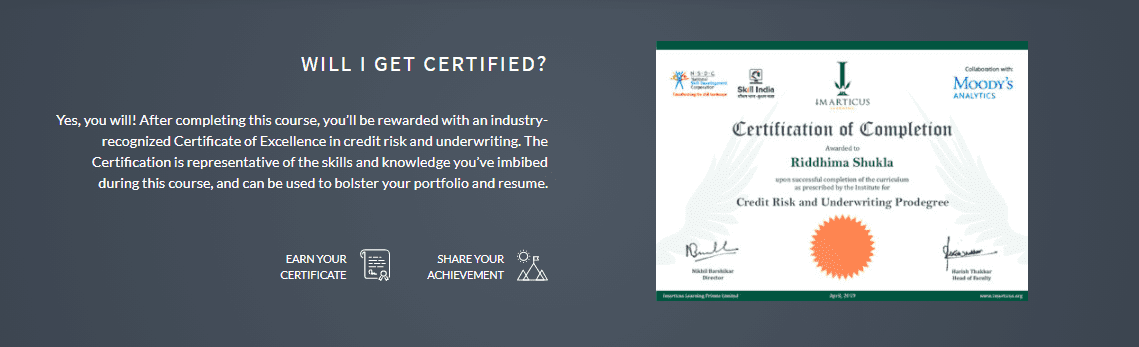

Students who wish to have a successful career in the financial sector can enroll in Imarticus Learning's credit risk underwriting course. Imarticus Learning offers a credit risk and underwriting Pro degree. The course is in collaboration with Moody's Analytics. It is ideal for students who want to learn about dynamic banking and loan markets.

Instructors guide students through the credit landscape of the country and help them understand the various ways of loan assessment and financial analysis. This credit analyst course teaches topics like credit administration, credit underwriting, and the use of new-age software solutions for better credit risk assessment. Imarticus Learning and Moody's Analytics offers an industry certification for all students.

The credit analyst certification course from Imarticus Learning includes live lectures so that students can interact with instructors. Students gain valuable industry experience through this course. It is ideal for a career transition to the FinTech industry.