The investment banking industry has been in a state of flux for the past few years. The old school model of going into a company and advising them on mergers, acquisitions, restructuring, etc., is slowly but surely being replaced by a more service-oriented approach with an emphasis on consulting and advisory work.

In this new era of change, banks must find ways to make themselves relevant in the eyes of clients who have access to so much information from so many sources that they can't always be bothered to consider what one particular bank might offer over another.

Why is there a reason for the changing paradigm?

Clients are far more informed about investments and business deals than ever before. For example, there is no such thing as an 'undiscovered gem' anymore. Thanks to the proliferation of websites and social media platforms that constantly bombard us with news stories and updates. Even companies and entrepreneurs who thought they had a good thing going in the desert might quickly find themselves out in the cold when someone gets wind of their success and decides to come in and take over.

The housing market is booming, and prices are sky-high.

Investment banks need to buy up land quickly to make a profit while prices are still high, especially before banks become more active in this area and drive up prices even further. For example, suppose a housing development is started but never completed because the bank only bought up some of the plots of land available.

In that case, those who bought their homes from that particular developer could find themselves with empty lots and unfinished infrastructure right next to their homes. Suppose the bank only buys up part of that land while developers still think they have access to all of it. In that case, you could see some complications arise down the road, such as public utilities and other necessary infrastructures being incomplete.

As an investor or client, there are certain things you can do to make sure your investment bank is representing you to the best of its abilities. Make sure you can trust a company or a developer who claims to have access to an unlimited amount of resources and land because if they don't possess those things, there might be trouble down the line.

Explore Investment Banking with Imarticus Learning

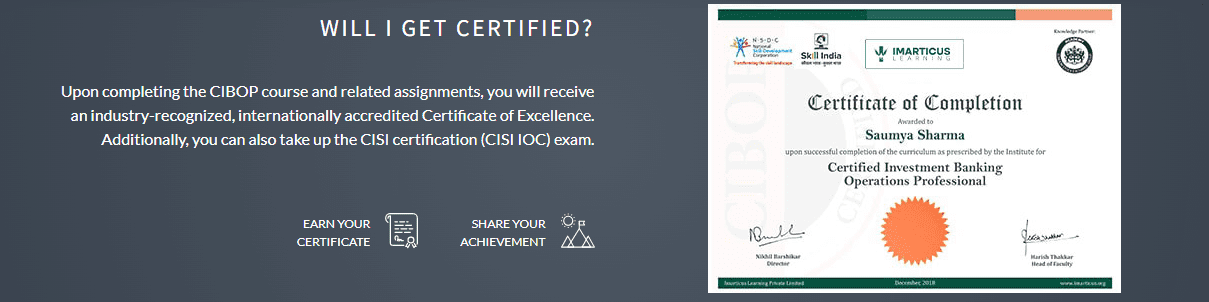

Students can quickly achieve the opportunity to work at most global investment banking courses with placement assistance and the CIBOP certificate, which the London Stock Exchange approves. Students can get full career help to begin their investment banker courses with 8000+ placements accomplished with 60 percent compensation increases.

Some course USP:

Some course USP:

- This Investment Banking courses with placement assurance aid the students to learn job-relevant skills that prepare them for an exciting career.

- Impress employers & showcase skills with a certification endorsed by India's most prestigious academic collaborations.

- World-Class Academic Professors to learn from through live online sessions and discussions. It will help students understand the 360-degree practical learning implementation with assignments.

Contact us through the live chat support system or schedule a visit to training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Hyderabad, Delhi, and Gurgaon.