In today’s era, financial decisions by businesses and investors are taken only after conducting proper research. Financial decisions can include investing in a company or opting out of a share/stock. There is no limit to financial decisions that can be encountered by businesses and investors.

To decide whether a financial decision is beneficial or not, equity research is performed. You can also build your career as an equity research analyst and work with the top organizations. Read on to know more about making a career as an equity research analyst.

Understanding the role of an equity researcher

Understanding the role of an equity researcher

An equity researcher is responsible for carrying out an analysis of a firm, stock, or any other type of financial entity. The information produced by equity researchers is then used by investment banks, shareholders, and companies to make better financial decisions.

For example, investors perform equity research to know which investment ventures will provide a huge return in the future. Companies value a project with the aid of equity research to make sure it is beneficial. In short, equity research is the valuation of a company or a venture/project.

An equity research analyst performs the following tasks for its organization/client:

- An equity researcher has to develop a company portfolio that will be used to generate capital from investors. Company portfolio will be the ideal documents used in investment meetings and IPOs.

- An equity researcher develops financial models and calculates the estimated income, cash flow, revenue, and returns of capital.

- An equity researcher monitors the market situation continuously and provides updated reports to investors. Based on the generated reports, investors can then make better decisions.

- An equity researcher evaluates the financial position of the firm in comparison to its competitors. This also predicts the growth of a company based on current performance and trends.

How to become an equity researcher?

You will have to learn the basic skills of financial analysis and modeling to become a successful equity researcher. Colleges in India do not offer a designated course for equity research. It can be included as a subject/topic in a traditional college course. For learning financial analysis, you may have to opt for the complete degree program. Also, the recent COVID pandemic has made it tough for colleges in India to conduct classes.

Nowadays, students are leaning towards EdTech platforms for financial analysis courses. You need to select an industry-oriented financial analysis course that could make you job-ready. Imarticus Learning is a reliable source that can help you in building a successful career as an equity researcher.

Why choose the financial analysis course from Imarticus?

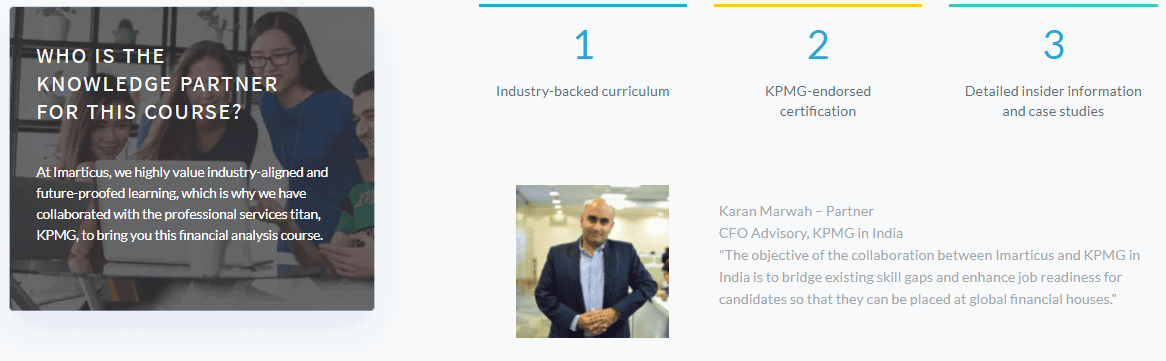

The Financial Analysis Prodegree offered by Imarticus is endorsed by KPMG, a leading accounting firm in the country. The pros of choosing the financial analysis course of Imarticus are listed below:

- This course will help you in an easy career transition and will make you job-ready. Imarticus has successfully transformed the career of more than 2400 enthusiasts.

- Six real-world projects offered by this course to students make it one of the best financial modeling courses in India.

- A KPMG-endorsed curriculum will ensure that you learn the job-relevant skills and common practices in the industry.

- Most of the financial modeling courses do not provide tech-enabled learning. This course will also introduce you to the tools and technologies used by equity researchers in the industry.

Conclusion

Imarticus will help you in learning the concepts of equity research from industry experts. With a practical learning approach, you will learn equity research techniques by performing them in real life. You will obtain industry certifications during this course that will enhance your credibility as an equity researcher.

Imarticus will help you in learning the concepts of equity research from industry experts. With a practical learning approach, you will learn equity research techniques by performing them in real life. You will obtain industry certifications during this course that will enhance your credibility as an equity researcher.