An investment bank stands as the intermediary between businesses that need to raise funds and investors who can invest. Therefore, companies need to issue securities, and investors decide to provide money in exchange. The work of an investment banker is to handle all the transactions happening between both the parties. Here, we will take you through the basics of how to start an investment banker career.

What is Investment Banking?

Investment banking is a part of the finance industry where the target is increasing and managing clients’ financial assets. The investment bankers assist organizations in investing their assets to increase the value of their profiles. If you choose the investment banker career, you will become an advisor to help clients capitalize on credible opportunities.

You must know that investment banking falls under a special division in the finance industry at a basic level. It serves the central government, state government, commercial banks, non-commercial banks, corporations, institutions, etc.

Investment banks offer complete guidelines about mutual funds and stock. Thus, it acts as an advisor and guides investors to put their money in the most profitable place.

Functions of Investment Banks

Before you join an investment banking course, know the kind of work you will be responsible for. These are the main functions of an investment bank:

- Securities research: Investment bankers use the “Hold,” “Sell,” and “Buy” rating system to research and provide detailed reports. They find out the status of a company, investments they made, and other necessary details to check their credibility.

- Investment management: Investment bankers help companies by giving them the correct suggestions regarding their investment. Since they take over the research and analysis, they have a sound method of understanding what would benefit their clients the most. They help businesses that need financial aid and also enable investors to choose the best organizations for investment.

- Proprietary trading activities: Bankers in this financial institution help in selling and buying of assets to bring profit in every trade. These financial products are bonds, stocks, derivatives, and more.

Why become an investment banker?

Investment bankers are highly respected professionals in the finance sector. They help companies get the necessary funds to achieve their goals. They are also responsible for helping companies attract investors and determine what is the best way to solve their financial issues. A career in investment banking can be highly lucrative and rewarding. The statistics are the best proof for this claim.

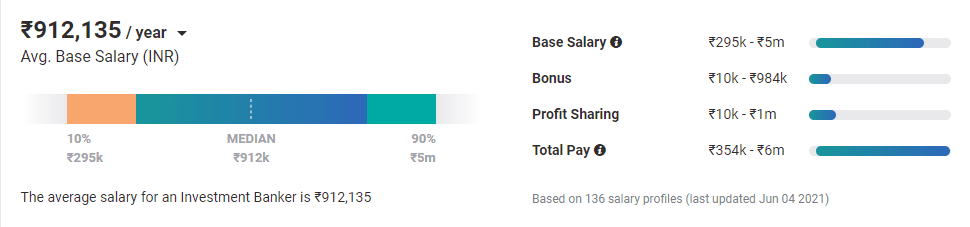

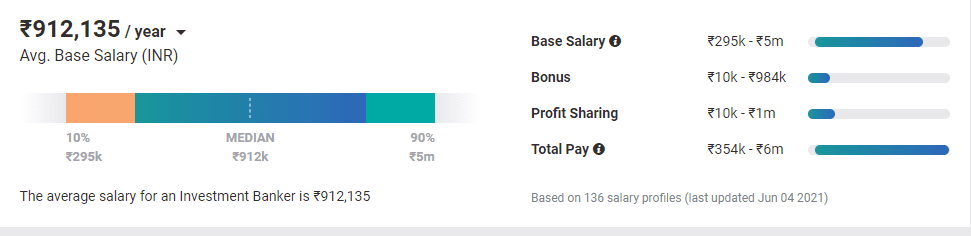

In India, the average pay of an investment banker is ₹9.04 lakhs per year. Their salary starts from ₹2.86 lakhs per annum and goes up to ₹50 lakhs, depending on their experience, skills, and employer.

You can easily bag a high-paying salary in this field as you gain experience. The average salary of an investment banker with five to nine years of professional experience is ₹20 lakhs per year. Apart from the lucrative pay package, you will also have the opportunity to work with senior executives, investors, venture capitalists, and other highly esteemed individuals when you will be working as an investment banker.

You can easily bag a high-paying salary in this field as you gain experience. The average salary of an investment banker with five to nine years of professional experience is ₹20 lakhs per year. Apart from the lucrative pay package, you will also have the opportunity to work with senior executives, investors, venture capitalists, and other highly esteemed individuals when you will be working as an investment banker.

Further, becoming an investment banker would provide you with a stable and secure career path. Investment bankers are regarded as one of the best-paying jobs globally, so it is certainly worth the effort and time.

Further, becoming an investment banker would provide you with a stable and secure career path. Investment bankers are regarded as one of the best-paying jobs globally, so it is certainly worth the effort and time.

How to start a career as an investment banker?

To become an investment banker, you will need to be well-acquainted in management, statistical analysis, finance, financial law, and other relevant subjects. Investment bankers have to create fully detailed financial models to facilitate M&A (merger and acquisitions) transactions, and financial planning and analysis.

They also have to evaluate companies for investments and use different methodologies, such as LBO (leveraged buyout) and transaction comparisons, for the same.

Due to such complexity of this role, companies look for certified and highly skilled professionals. That is why it is best to get an investment banking certification to become a professional in this sector.

There are many courses for investment banking in India. You should choose the ones that teach you the necessary concepts most efficiently.

It is best to look for online courses for investment banking as they teach you financial modeling, statistical analysis, and other important concepts safely without requiring you to leave home or go anywhere.

Investment Banker Career Positions

The investment banker career grows along a straight path. Here are the positions from juniors to seniors as investment bankers:

- Analyst: Your career will start as an analyst as you can become one as soon as you’re out of college. Prior knowledge of 1-2 years in the financial sector is even better to add credibility.

Your job profile will be collecting data, creating presentations, and analyzing financial data. Thus, as an aspirant, you must go through this process to understand how the world of investment banking works. - Associate: You need around three years of experience as an analyst to get promoted as an associate. At this point, you interact with clients, manage teams of analysts, and more.

- Vice President: A vice president in an investment bank has years of experience in the field. They build and maintain client relationships and ensure operational efficiency at each level under them.

- Managing Director: It takes around 15 to 20 years to become an MD in the field of investment banking. MD’s primary focus is getting more work into the business and converting potential clients into real deals.

Final thoughts

The first step to investment banking is to have a bachelor’s degree in finance and accounting. If you have a master’s degree, your credibility will be higher. Many aspirants complete their MBA before joining an investment bank. You need to be well aware of subjects like marketing, economics, accounting, mathematics, and more. Lastly, you need to have a license for several stock exchange programs to get through as an investment banker.