Financial modeling is used for representing any company or project in number. An organization can know whether starting a new project will be beneficial for the company or not. The importance of financial modeling has forced corporate organizations to hire expert financial analysts.

However, there is a need to create effective financial models that could predict the financial impact accurately. It is why organizations invest in financial analyst training so they could develop better financial models. Read on to know some of the best practices for financial modeling and the required resources.

Best practices for creating effective financial models

Best practices for creating effective financial models

Before starting a new project or company, you should develop financial models to predict the financial impact. One can take better business decisions if they have accurate financial models. Some of the practices for creating effective financial models are as follows:

- Decide the intention and goal of developing the financial model

What issue is going to be resolved by the financial model? Financial models can tell you about the performance of stocks/shares, financial position, and much more. You need to decide the financial factors that you want to know by developing a financial model.

- Try to create a straightforward model

Financial analysts are expert individuals when it comes to understanding financial statements. However, the financial model will be used by company executives, shareholders, and business owners to make better decisions. A financial model should be straightforward so it could be understood by all.

You need to decide on minimum inputs and outputs that could successfully create the financial model. You need to use only those financial factors in your model that could help in achieving the output explained in the above pointer.

- Plan the structure of your financial model

You need to decide how inputs and outputs will be laid across your financial model. Usually, excel sheets are used for creating a financial model. Make sure the structure of your financial model is easy to understand by everyone.

- Think about data integrity

You need to make sure the financial data presented in your model is accurate, consistent, and complete. There should be no missing values in your financial model. Data validation and conditional formatting offered by Excel could help you in ensuring data integrity.

- Test your financial model

To test the effectiveness of your financial models, you can provide dummy values in the input section. You can run stress tests by feeding hyperbolic scenarios that may occur at some point. Financial analyst training can help you in knowing more about how to test a financial model.

Resources for financial modeling

The most crucial resource for data modeling is financial data. Without abundant financial data, you cannot create an accurate financial model. Applications like Excel and PowerPoint are used by financial analysts to create financial models. Before developing a financial model, you may have to indulge in transactions analysis, equity research, etc. A financial modeling course can help in knowing the best resources for creating accurate financial models.

Learn financial modeling with Imarticus

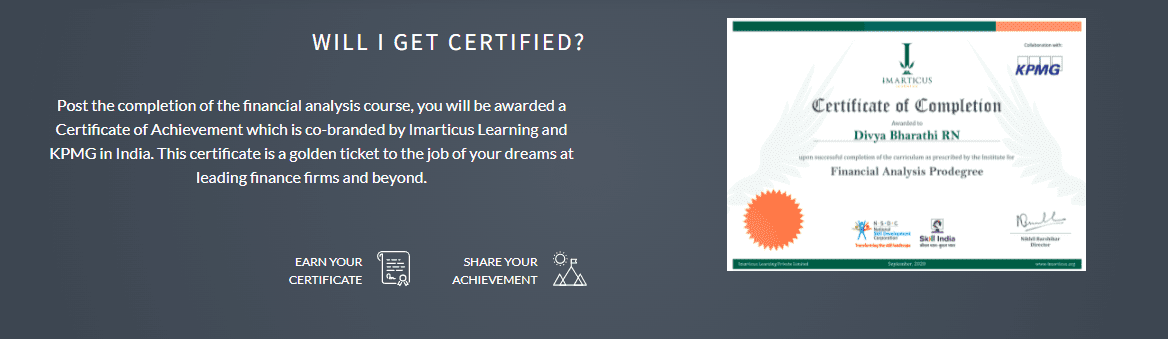

Imarticus Learning is now a common name among those looking for financial modeling courses. We circulate a Financial Analysis Prodegree (FAP) for those looking to become successful financial analysts. The financial analyst certification provided at the end of the course will also be endorsed by KPMG. You can get a lucrative job in the finance sector with an industry-recognized financial analyst certification.

The FAP course will allow you to work on numerous real-world projects related to financial modeling. You will also learn how to develop accurate models with Excel and PowerPoint. Start your financial analysis course now to learn financial modeling!