Financial accounting is a key feature of performing financial statement analysis. The analysis of financial statements is a very important tool that allows companies to calculate profitability and study other financial parameters for a certain period of time. Financial accounting also allows the scrutiny of a company so that collective efforts can be taken towards proper interpretation.

Read on to learn about all the methods and techniques of financial statement analysis. If you are looking to become a financial analyst, then these tools and techniques will be useful.

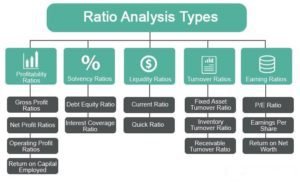

Ratio Analysis

Ratio analysis is one of the best quantitative analysis tools. It is responsible for establishing various relationships between multiple aspects of financial statements. It helps to analyse the degree of change in the quantity that affects the balance sheet, income statement, cash flow statement and so on.

Further, ratio analysis is an integral tool that is used for analysing a company's financial performance. Financial analysis like this helps a company to take important decisions in the area of liquidity, solvency, profitability, efficiency, etc.

Common Size Statements

Often overlooked, a common size statement is as important as any other tool of financial statement analysis. The distinct element of a common size statement is that it calculates everything for a company on a base percentage basis. It directly impacts the financial statements of a business with a common figure and that is why, it is known as a common size statement.

A common-size statement helps you to compare a company's performance and results with another. Besides, another scenario can be that it allows the comparison of the performance of a company for two or more different periods. Notably, the comparison of performance is the key element of this financial statement analysis tool.

Comparative Statements

A company's financial statements for different periods of time are known as comparative statements. To derive the result of comparative statements, financial analysts have to use various techniques that may compare the result of the financial performance for different time periods. Various elements of financial statements are compared and presented in the form of a table. This helps to make the data of various time periods short and crisp.

A financial analyst course will help you to learn all about comparative statements in great detail. Do not miss out on them because without the knowledge of comparative statements you cannot become a successful financial analyst.

Fund Flow Analysis

A fund flow analysis or statement enables you to know the allocation of funds in your organisation. Without it, you cannot prepare the financial statement or utilise any other financial analysis tool. This analysis clearly shows the availability of resources in your organisation.

Apart from the availability of resources, it also helps to analyse the application of resources for a certain period of time. A fund flow statement requires a decent amount of research. It also makes it visible if there occurs any changes in the financial position of an organisation from the start of the accounting period to the end of the same.

Cash Flow Statement

A cash flow statement is another important financial analysis technique that depicts all the cash and cash equivalents inflows and outflows. If any of the cash or cash equivalents is affected by any change in the business, then the cash flow statement also brings that to light. You can easily compare cash flow statements to balance sheets to know the reasons behind the change in cash positions if occurs.

Also, a cash flow statement acts as a guide for preparing a balance sheet and a profit and loss account. It constantly allows a financial analyst to get the right cash balance of a company. Not only the inflow and outflow of cash but also the reasons behind the change in the cash position in a company are also stated in a cash flow statement. It acts as a summary of the cash account in a business.

Trend Analysis

Trend analysis is not a quantitative tool but a theory that acts as a technique for various organisations. It is based on the underlying principle that 'what has happened in the past indicates what will happen in the future’. It is not completely a mathematical method as it uses historical data for its proper formulation.

Moreover, trend analysis can be adapted for two or more organisations at the same time or two or more periods of analysis of the performance of an organisation. It holds a series of information that helps you to arrive at some specific conclusions.

Bottom Line

These are all the major tools and techniques of financial statement analysis. If you are passionate about financial analysis and want to have a career in this discipline, then a financial analyst course can help you in this regard. Learn financial analysis with the help of the financial analysis certification course by Imarticus and excel in this field so that you can kick-start your career.